MEES Exemptions for Domestic Properties

This page is a 'work in progress'. Note that all responsibility when raising a MEES exemption lies with the landlord. MEES exemptions are self-certified and not pre-checked for validity before being accepted onto the PRS register. Landlords should therefore take all reasonable steps to ensure their application is valid, such as double-checking with their local authority and the PRS Register, and reading the MEES regulations in full on the government website before registering an exemption. Do not rely on any of the information on this web page. I am not legally qualified. Penalties may apply if your exemption is not valid and is challenegd at a later date.

Introduction

On our previous page we discussed the Minimum Energy Efficiency Standards (MEES) for domestic properties, which impose a minimum EPC rating that properties must achieve when being rented out in the Private Rental Sector (PRS).

This currently applies to England & Wales only, and an EPC rating of at least a band E is required, meaning it would be unlawful to rent out a property with an F or G rating.

A number of exemptions are available from this legislation however, and if you qualify, they allow you to rent out the property in the private rental sector even with an F or G EPC rating.

This page is about those exemptions.

Reference should be made to the Landlord Guidance for MEES on the Government website here:

...and also the Government's Exemptions and Evidence Requirements documentation here:

A quick look at the legislation

MEES was initially enacted in secondary legislation through the following Statutory Instrument (S.I.):

- The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 - SI 2015/962

https://www.legislation.gov.uk/uksi/2015/962/contents

This is the principal MEES instrument. It introduced the minimum EPC requirements and the basic enforcement and exemption framework.

This however was later modified by the following two further SIs:

- The Energy Efficiency (Private Rented Property) (England and Wales) (Ammendment) Regulations 2016 - SI 2016/660

https://www.legislation.gov.uk/uksi/2016/660/contents/made

This made technical and clarifactory amendments to the 2015 regulations ahead of full commencement.

- The Energy Efficiency (Private Rented Property) (England and Wales) (Ammendment) Regulations 2019 - SI 2019/595

https://www.legislation.gov.uk/uksi/2019/595/contents/made

This significantly amended the regime, including changes to enforcement, penalties, exemptions, and application to certain leases.

I mention these instruments because they contain the detail of the regulations.

To understand the exemptions properly you need to refer to the regulations presented in these SIs.

The trouble is, the government website does not yet present the 2015 S.I. with both the 2016 and 2019 amendments applied, which makes it difficult to read and fully comprehend, unless you merge the documents together yourself.

Validation of MEES Exemptions

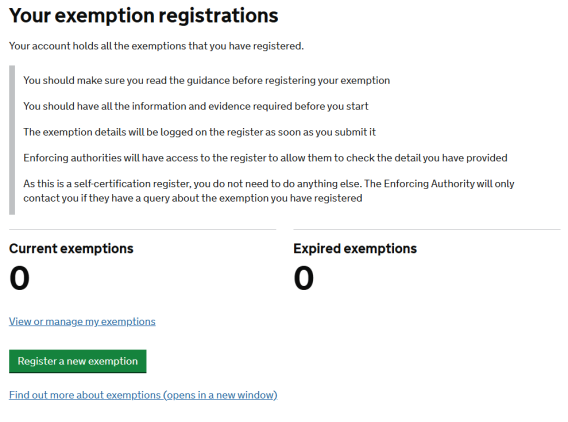

In England & Wales there is no body that 'pre-validates' PRS (MEES) exemptions entered onto the register.

The landlord is responsible for:

- Determining whether an exemption applies

- Obtaining the required evidence such as quotes, reports and consent refusals

- Registering the exemption on the PRS Exemptions register

Registration of exemptions is therefore effectively self-certified.

You upload the details and evidence, but the application is not pre-approved or checked in advance.

An exemption therefore might only be considered to be truly 'validated' if and when the local authority reviews it. Until then it relies entirely on the landlord having registered it correctly and holding valid evidence.

Enforcement

Local authority enforcement teams (usually Trading Standards) are responsible for:

- Checking and validating exemptions retrospectively

- Requesting evidence if they investigate or receive a complaint

- Deciding whether the exemption is valid

- Issuing compliance notices, penalties and fines if it is not

'Relevant Energy Efficiency Improvements'

MEES regulation 24 defines the term 'relevant energy efficiency improvements'.

You should read this regulaton to understand the meaning of this term, and what is included, and what is not.

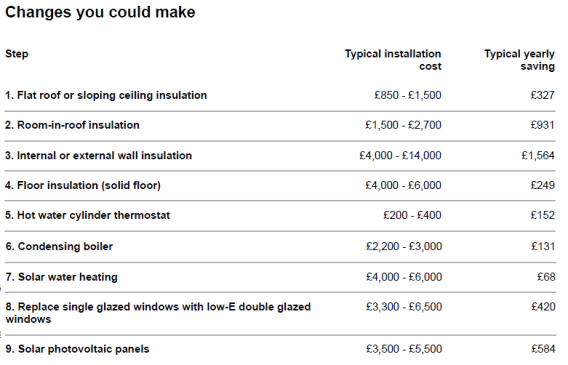

This is essentially a list of energy improvement measures that are applicable to the property. The regulation describes where this list comes from, but often this will be the Recommendations on an EPC certificate.

It allows you to remove any items whose individual cost would be above the cost cap, currently £3,500 (but minus the cost of qualified improvements that have already been made by the landlord (this is also explicitly defined)).

It also allows you to remove; cavity wall insulation, external wall insulation and internal wall insulation if they are specifically deemed by suitably qualified people as being not appropriate improvements, due to their potential negative impact on the fabric or structure of the property, or the building of which it forms part. Specific qualifying evidence is required for this however.

It defines the cost cap of £3,500 and you could probably read it such that the landlord is required to spend up to £3,500 to try and get the EPC rating of the property up to at least an E, and improvements beyond this financial value can be removed from the list. There does not appear to be any guidance around which recommendations should be implemented in the list and which ones can be removed once the £3,500 figure has been reached, but it would be sensible for a landlord to carry out the best ones they can up to £3,500 which would make the best improvement to the EPC rating.

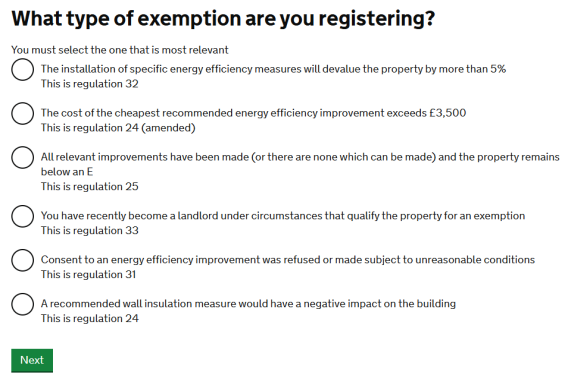

The MEES Exemptions

Further advice should be sought before applying for an exemption. Do not rely on any information presented on this page. There may be some nuance in what can be claimed for and what a landlord should or must do, and every property is different.

The available exemptions are:

- The 'Cheapest improvement is over £3,500' Exemption

- The '7 Year Payback' Exemption (non-domestic only)

- The 'All Relevant Improvements Made' Exemption

- The 'Wall Insulation' Exemption

- The 'Consent' Exemption

- The 'Devaluation' Exemption

- The 'New Landlord' Exemption

All of the above are applicable to domestic properties, except for the '7 year payback' exemption.

Let's review each of these exemptions in turn.

References in the following headings are centered around exemptions for domestic properties.

The 'New Landlord' Exemption (Regulation 33)

This is captured in Regulation 33(1) & Regulation 36 (2), and applies to both domestic and non-domestic (i.e. commercial) properties.

If you have recently become a landlord, under certain circumstances you will not be expected to take immediate action to improve your property to EPC band E.

The specific circumstances are listed in section 4.1.6 in Chapter 4 of the full Guidance document, available here:

You may claim a 6 months exemption from the date you became a landlord.

After that, it will expire, and by then you must have either:

- Improved the property to EPC Band E, or

- Registered another valid exemption, if one applies

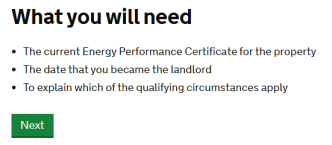

When you register this type of exemption, you are asked to upload the current EPC for the property, provide the date that you became the landlord, and explain which of the qualifying circumstances apply.

The '7 Year Payback' Exemption (Non-domestic only)

This is defined in Regulation 28(3).

This exemption only applies to non-domestic (ie commercial) properties, and we will not look at it in detail here.

"The prohibition on letting non-domestic property below an EPC energy efficiency rating of E does not apply if a landlord can show that the cost of purchasing and installing a recommended improvement or improvements does not meet a simple 7 year payback test. A measure, or a package of measures, will fail the 7 year payback test where the expected value of savings on energy bills that the measure (or package of measures) is expected to achieve over a period of 7 years, starting with the date the installation is completed, are less than the cost of repaying it. The formula for the 7 year payback test is set out in regulation 28(3) – (8) and are described in chapter 2 of the non-domestic guidance."

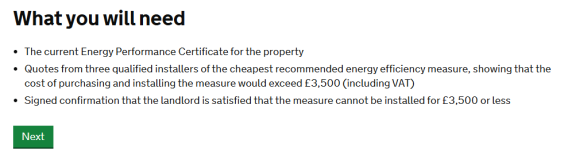

The 'Cheapest Improvement costs over £3,500' Exemption (Regulation 24 - Ammended)

To qualify for this exemption, the cheapest recommended energy efficiency measure needs to cost more than the 'cost cap' of £3,500.

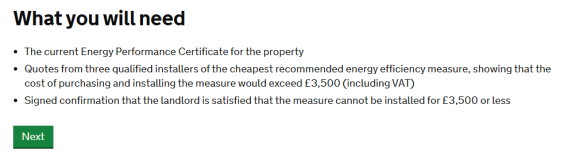

You'll need to upload the EPC for the property, quotes from three qualified installers showing the cheapest measure would cost more than £3.500 and you'll need to confirm you are satisfied the measurre cannot be installed for £3,500 or less.

The '5% Devaluation' Exemption (Regulation 32)

You can register for this exemption if you have evidence showing that making energy efficiency improvements to your property would devalue it by more than 5%.

In order to register this exemption you will need a report from an independent surveyor. This surveyor needs:

- to be on the Royal Institute of Chartered Surveyors (RICS) register of valuers

- to advise that the installation of the relevant improvement measures would reduce the market value of the property, or the building it forms part of, by more than 5%

This exemption lasts 5 years.

After this period of time it will expire and you must try again to improve the property’s EPC rating to E.

If it is still not possible, you may register a further exemption.

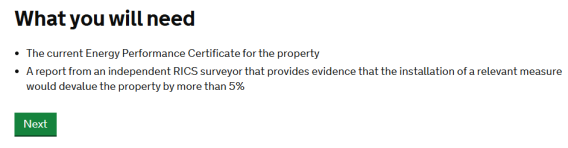

You'll need to upload the EPC for the property and a report from an independent RICS surveyor providing evidence that the installation of a releveant measure would devalue the property by more than 5%.

The 'All Relevant Improvements Made' Exemption (Regulation 25)

This exemption applies when: "The landlord of a sub-standard property has made all the 'relevant energy efficiency improvements' or there are no 'relevant energy efficiency improvements' that can be made to the property".

This might be the case where the landlord for example has made all the 'relevant energy efficiency improvements' and therefore spent up to the cost cap of £3,500 (details required) and/or it could be where the list of 'relevant energy efficiency improvements' is empty because (other) measures were not included in the list because they cost over £3,500 each (evidence required), or were wall insulation measures that were eliminated by not being appropriate due to their potential negative impact on the fabric or structure of the property, or the building of which it forms part (evidence required).

This exemption applies for a period of 5 years.

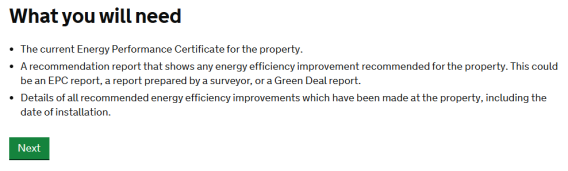

The PRS Register website indicates the landlord must provide:

- The current EPC certificate for the property (perhaps a fresh one if some improvements have been made)

- A recommendation report that shows any energy efficiency improvement recommended for the property. Perhaps this could be a previous EPC certificate for example if some improvements have been made, although other options are listed

- Details of all the recommended energy efficiency improvements which have been made at the property, including the date of installation

A landlord might also look to provide as much evidence of their thinking as possible, and include any evidence mentioned above to support the exemption registration in case it is challenged in the future.

The 'Wall Insulation Exemption' (Regulation 24)

Advice on this exemption is available in the Government's landlord guidance here:

...and also in the Government's Exemptions and Evidence Requirements documentation here:

You can apparently register this exemption if the only relevant improvements for your property are:

- Cavity wall insulation

- External wall insulation, or

- Internal wall insulation (for external walls)

AND, you have obtained written expert advice showing that these measures would negatively impact the fabric or structure of the property (or the building of which it is part).

I'm actually a bit confused about this exemption and think this one is redundant.

Regulation 24 actually defines the term 'Relevent Energy Efficiency Improvements', which can include a number of items, and clauses within this regulation explcitly describes removing these particular measures if they 'negatively impact the fabric or structure of the property' etc. resulting in them not being included in the list anyway. Therefore, I can't see how you would need a separate exemption for this because surely you have the 'All relevant improvements made' exeption which you would use instead?

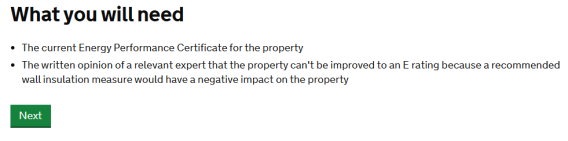

However, this specific exemption is listed on the PRS Exemption Register, and a landlord is advised they need to upload the current EPC for the property, and the written opinion of a relevant expert that the property can't be improved to an E rating because a recommended wall insulation measure would have a negative impact on the property.

The Exemptions & Evidence Requirements guidances referrenced above advises the expert advice the landlord provides must be obtained from one of the following independent experts:

- An architect registered on the Architect Accredited in Building Conservation register

- A chartered engineer registered on the Institution of Civil Engineers’ and the Institution of Structural Engineers’ Conservation Accreditation Register for Engineers

- A chartered building surveyor registered on the Royal Institution of Chartered Surveyors’ Building Conservation Accreditation register

- A chartered architectural technologist registered on the Chartered Institute of Architectural Technologists’ Directory of Accredited Conservationists.

Alternatively, if the advice is not, or cannot be, obtained from one of the above experts, advice may be obtained from an independent installer of the wall insulation system in question who meets the installer standards for that measure, as set out in Schedule 3 to the Building Regulations 2010.

Landlords are further advised that once registered, the exemption will last 5 years; after this time it will expire and the landlord must try again to improve the property’s EPC rating to meet the minimum level of energy efficiency. If this cannot be achieved then a further exemption may be registered.

The 'Consent' Exemption (Regulation 31)

Depending on circumstances, certain energy efficiency improvements may legally require consent from a third party before they can be installed in a property.

Such improvements may include (but are not limited to) external wall insulation or solar panels which can require local authority planning consent, consent from mortgage lenders, or other third parties.

Consent from a superior landlord may be required where the landlord is themself a tenant.

Consent may also be required from the current tenant of the property or other tenants, depending on the provisions of the tenancy or tenancies.

Note that if this exemption is qualified by the landlord being unable to obtain consent of a tenant then the landlord cannot rely on the exemption once the tenant's tenancy comes to an end.

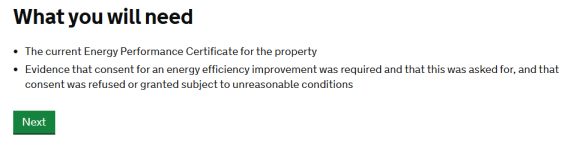

So support this exemption, evidence is required, such as copies of any correspondence and/or relevant documentation demonstrating that consent for a relevant energy efficiency measure was required and sought, and that this consent was refused, or was granted subject to a condition that the landlord was not reasonably able to comply with.

Penalties

Penalties available for the local authority to apply if they investigate and discover an infringement has occurred.

DOMESTIC PROPERTIES

For renting out a non-compliant domestic property:

- for a breach of under 3 months: up to £2,000 and/or publication penalty

- for a breach of 3 months or more: up to £4,000 and/or publication penalty

Providing false or misleading information on the PRS Register: up to £1,000 and/or publication penalty

Failing to comply with a compliance notice: up to £2,000 and/or publication penalty.

NON-DOMESTIC PROPERTIES

For renting out a non-compliant non-domestic property:

- for a breach of under 3 months: not exceeding whichever is the greater of up to £5,000 or 10% of the reateable value of the property (subject to a maximum of £50,000) and/or publication penalty

- for a breach of under 3 months: not exceeding whichever is the greater of up to £10,000 or 20% of the reateable value of the property (subject to a maximum of £150,000) and/or publication penalty

Providing false or misleading information on the PRS Register or failing to comply with a compliance notice: up to £5,000 and/or publication penalty.

The PRS Exemption Register

Searching for an existing exemption

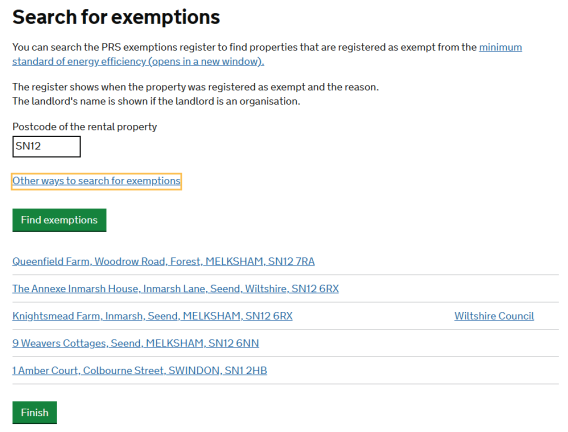

Navigate to: https://prsregister.beis.gov.uk/

Setup an account, log in, return to the address above and click the link for 'Search for exemptions'.

You can search using a small number of criteria, including by partial postcode:

Exemptions submitted by a company will have the company name alongside the property address, as shown above with one showing: Wiltshire Council.

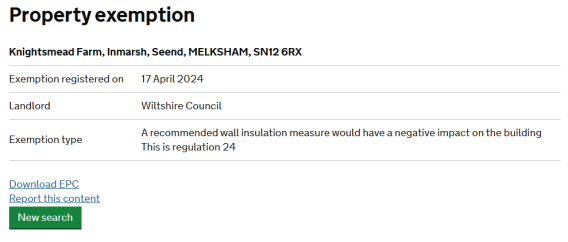

Click on the address to view information about the exemption:

Click on the Download EPC link to view the EPC and peruse the list of Recommendatins on it:

So, in this case the EPC was conducted on the 17th April 2024, and the Exemption was registered on the same day.

The exemption type was the Wall Insulation Exemption.

Now, what I am not clear about is whether the landlord should have implemented the other Recommendations on the EPC prior to registering the exemption.

Registering an Exemption

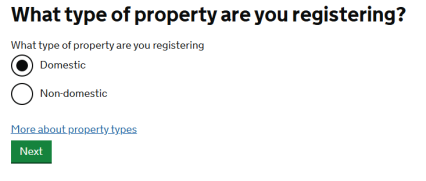

Navigate to the PRS Exemption website at: https://prsregister.beis.gov.uk/

Create an account and log in to your dashboard.

Click the green button: 'Register a new exemption'.

You are then asked which type of property you have; Domestic (i.e. residential), or Non-domestic (i.e. commercial).

Select the type of property you have and click the green 'Next' button.

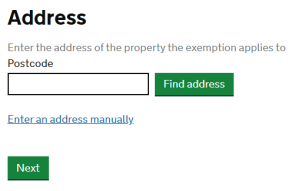

Select the type of exemption you wish to apply for, then click the 'Next' button. The following page then advises of the type of evidence you need to supply for that type of exemption.

In this example we chose the Cost based exempion (regulation 24), and we are advised of the type of evidence we need to supply. The equivalent page for other exemptins is shown in the sections above where we described each exemption.

Click the 'Next' button.

Enter the postcode of the property and click the 'Next' button.

Seeking advice from the PRS Exemptions register

In all cases, landlords should satisfy themselves they fully understand all requirements when submitting a MEES Exemption. Registrations are effectively self-certified.

If in any doubt, get in touch with the PRS Exemptions register by email PRSRegisterSupport@energysecurity.gov.uk or call their 'digital helpline' on 0800 098 7950

Challenging a PRS Exemption

If you believe a MEES exemption is invalid, you do not challenge it directly on the PRS Exemptions register.

Instead, you go through the local enforcement authority, which is usually the local council (trading standards).

MEES exemptions are self-certified by landlords, and are not pre-approved by government.

Local authorities enforce MEES and have the power to:

- Investigate exemptions

- Require evidence from the landlord

- Decide whether an exemption is invalid

- Impose penalties and compliance notices

This means only the local authority can invalidate an exemption.

You can raise a challenge if you believe the exemption is invalid because for example:

- The wrong exemption type has been used

- The property could reach EPC E within the £3,500 cost cap

To challenge an exemption, you first need to identify the enforcing local authority where the property is located.

Then you need to contact the council's trading standards team.

Your submission should include

- The property address

- The fact that a MEES exemption is registered

- Why you believe the exemption is invalid

- Any evidence you have (EPCs, listings, photos, adverets, dates etc.)

You do not need to prove the breach, only provide reasonable grounds for investigation.

Bear in mind there is no public visibility of the evidence uploaded to the Register by the landlord, only councils can see that.